About us

Hannover Digital Investments GmbH is a capital provider and partner for young, innovative companies specialising in digital solutions and services. Under the umbrella of the HDI Group (Talanx Group), Hannover Digital Investments contributes the financial strength and experience of one of Europe's largest, globally operating insurance groups to your start-up – and in so doing helps your company on its path to success.

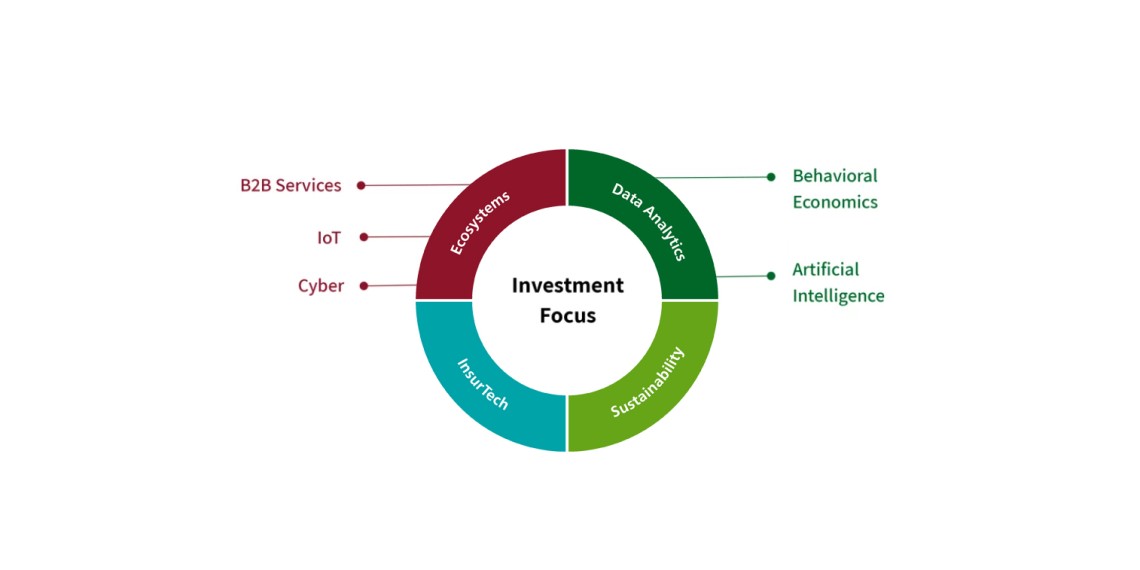

Focus

Your benefits

In addition to the financial investment, your cooperation with Hannover Digital Investments brings with it a number of advantages that are all but "priceless":

Valuable know-how & trusting cooperation

- We offer you exclusive access to the know-how of numerous in-house experts within the HDI Group on insurance and reinsurance matters. We partner with you on a trusting and open basis, contributing the experience of one of Europe's largest, globally operating insurance groups to your start-up. At the same time, your standing in the eyes of your customers and business partners benefits from this trust.

Exclusive access to a broad network

- Hannover Digital Investments cooperates with the Maschmeyer Group. In the role of co-investor, they assist us with search activities, due diligence checks and start-up support. Thanks to our shared, broad-based network, you come into contact with renowned industry insiders, decision makers, key bodies, investors and service providers.

Ongoing joint development & new customer groups

- Let's team up to identify how you can best deploy your innovations in the insurance industry and develop joint solutions – in an approach that is open, collaborative and fast-moving. The companies belonging to the HDI Group are constantly on the lookout for ideas to make processes more customer-friendly and bring new digital solutions and services to market. Our network enables you to cultivate new customer groups.

Investment criteria

As a traditional venture capital investor, Hannover Digital Investments GmbH makes early stage funding available for your enterprise.

- Focus: Financial investments from Seed to Series B

- Selected strategic investments

- Direct investments

- Minority investments

- Venture capital funds are excluded