Planck

Planck has developed an Artificial Intelligence data platform, which creates underwriting insights about any business, and helps insurers to grow both new and retained commercial business while reducing loss and expense ratios

Planck is a data solutions vendor in the commercial insurance market.Planck has developed an artificial intelligence platform, which is able to create underwriting insights about any business. Planck’s customers are commercial carriers in the US, such as Chubb and AIG, and Planck helps them to grow both new and retained commercial business while reducing loss and expense ratios.

It all comes down to data, as insurance is all about data to assess risks. Thus this mission is achieved, by simply providing carriers with all of the data they need, when and where they need it, with ultra-high accuracy.

Instead of creating a static database, for a closed list of businesses, with a closed set of questions - Planck has developed an amazing platform, which includes the best business search engine, with tens of thousands of machine learning models, that are continuously and in real time manufacturing data insights about businesses. This allows Planck, and its customers, to rapidly add unique insights and introduce new risk factors.

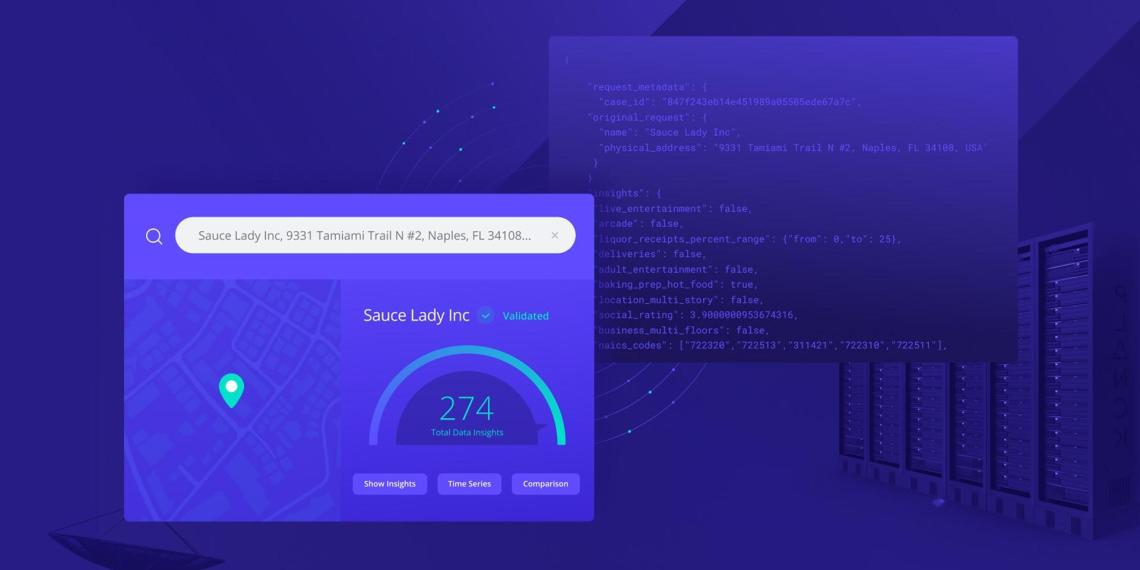

All that is required is a business name and address. Then, Planck’s AI-based platform gathers all publicly available data on the web related to the submitted business (images, text, videos, reviews, maps, public records, etc.), uses diverse capabilities, from image processing to natural language understanding, to pull all the relevant information from every piece of data, and lastly runs various deep learning capabilities to crunch all the extracted information in order to decipher the truth.Planck’s AI platform can return almost any insight underwriters can dream of, up-to-date and in real time. They are no longer limited by existing questionnaires or by what is plainly apparent over the web.

Planck’s AI platform can return almost any insight underwriters can dream of, up-to-date and in real time. They are no longer limited by existing questionnaires or by what is plainly apparent over the web.